Modern financial analysis focuses on monthly liquidity and income streams.

For decades, the ultimate measure of financial success was net worth—the total value of your assets minus your liabilities. It was a number to maximize, a scorecard for life. But as we move deeper into the 2020s, a profound shift is underway. In 2026, cash flow thinking is decisively replacing net worth as the dominant framework for personal and business finance.

This isn't just a trend among financial influencers; it's a response to economic volatility, changing work structures, and a new understanding of what "financial security" truly means. Let's explore why this shift is happening and how you can adapt.

The Limitations of the Net Worth Mindset

Net worth is a snapshot. It tells you what you own on paper, but it says little about your day-to-day financial health. You can have a high net worth locked in home equity or a retirement account and still feel financially strained.

- Illiquidity: Wealth tied up in non-income-producing assets (like a primary home) doesn't pay monthly bills.

- Volatility Blindness: Net worth can plummet with market downturns, offering false security during bull markets.

- Lifestyle Irrelevance: It doesn't directly fund your life. You can't spend net worth without selling assets.

The 2008 financial crisis and the economic uncertainty of the early 2020s exposed these flaws. People with "high net worth" faced cash crunches, while those with robust, diversified cash flow streams navigated challenges more smoothly.

The 2026 Drivers: Why Cash Flow Is King Now

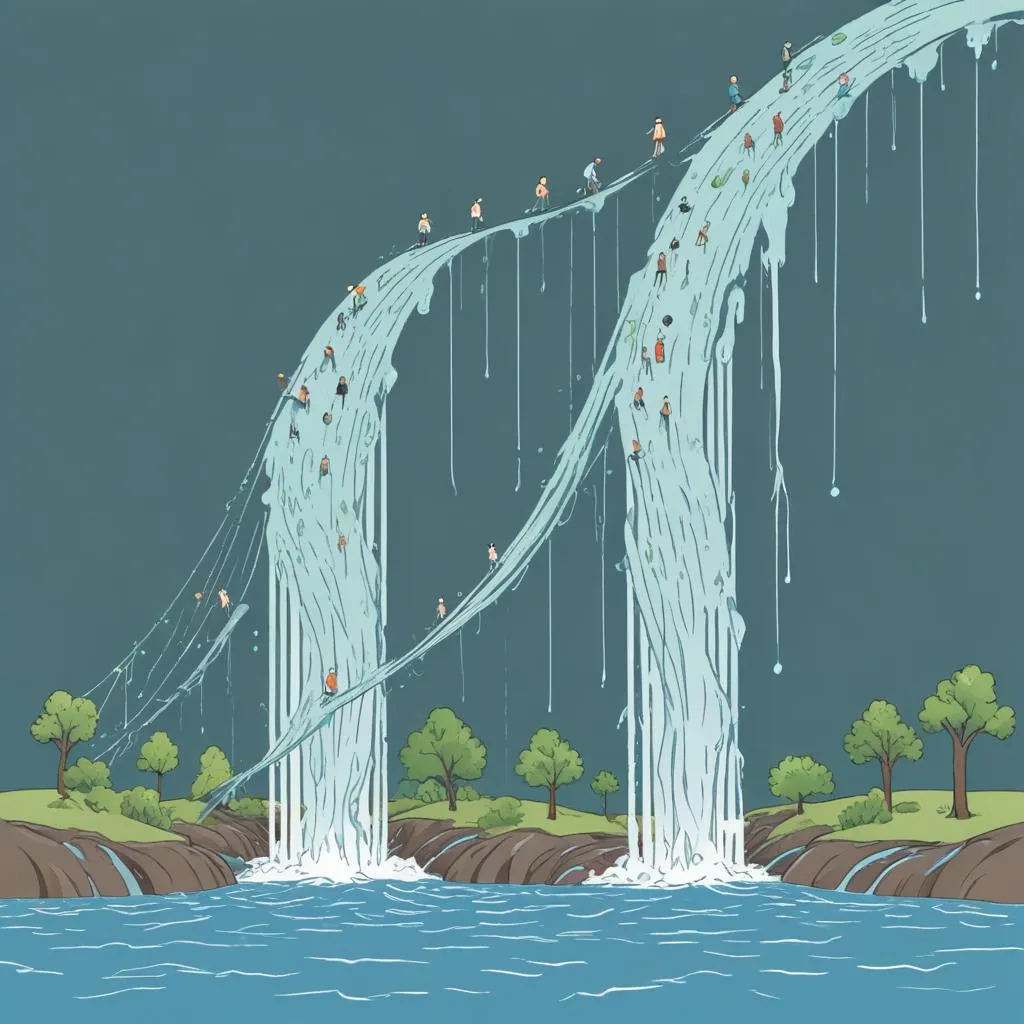

The modern financial goal: building multiple, resilient income streams.

1. The Gig & Digital Economy

With more people freelancing, consulting, and building online businesses, income is often variable and project-based. Success is measured by consistent monthly revenue, not a static asset balance.

2. The Pursuit of Financial Freedom

The "FIRE" (Financial Independence, Retire Early) movement and its successors prioritize passive income covering expenses. The goal isn't a magic net worth number, but the cash flow to sustain your lifestyle without active work.

3. Economic Uncertainty & Inflation

In an era of potential recessions and persistent inflation, liquidity is safety. Cash flow provides the flexibility to adapt, invest opportunistically, and weather storms without selling assets at a loss.

4. The Rise of Asset-Light Lifestyles

Younger generations often value access over ownership (subscriptions, rentals). This shifts focus from accumulating owned assets to managing subscription costs and ensuring positive monthly cash flow.

Cash Flow Thinking in Action: A Practical Shift

So, what does it mean to adopt a cash flow mindset? It changes your financial questions and strategies:

- Old Question: "What's my net worth?"

New Question: "Does my monthly passive income cover my core expenses?" - Old Goal: Pay off my mortgage to increase net worth.

New Consideration: Could I invest that capital for a higher cash-on-cash return than my mortgage rate? - Old Metric: Total portfolio value.

New Metric: Portfolio yield and dividend growth rate.

Investments are evaluated not just for capital appreciation, but for the income they throw off (dividends, rent, royalties). Liabilities are analyzed based on their impact on monthly cash flow, not just total debt.

How to Start Transitioning to a Cash Flow Framework

The first step is tracking and understanding your personal cash flow in and out.

- Track Your Personal Cash Flow: For 3 months, meticulously track all cash inflows (salary, side income, dividends) and outflows (bills, discretionary spending). Know your baseline.

- Build Your "Cash Flow Statement": Mimic a business. Categorize cash flow into Operations (day-job income), Investing (dividends, rent), and Financing (loan payments). Aim to grow the Investing section.

- Prioritize Income-Generating Assets: Allocate a portion of investments to assets that provide regular cash returns (e.g., dividend stocks, REITs, bonds, peer-to-peer lending).

- Reduce "Bad" Cash Flow Outflows: Identify high-interest debt and subscriptions that don't add value. Eliminating a $100 monthly payment is as powerful as earning an extra $100 in passive income.

- Diversify Your Income Streams: Aim for 3-5 sources of income (e.g., job, rental income, digital product sales, investment yields). This creates resilience.

The Bottom Line for 2026 and Beyond

Net worth isn't obsolete—it's still a crucial long-term metric. But as the primary focus, it's being dethroned by cash flow. In 2026, financial wisdom means understanding that liquidity fuels opportunity, and income streams create freedom.

The most financially secure individuals won't just be those with the highest net worth statement; they'll be those with the most robust, diversified, and resilient cash flow systems. The question is no longer "What are you worth?" but rather "How does your money flow?" Start optimizing for flow, and the net worth will follow.